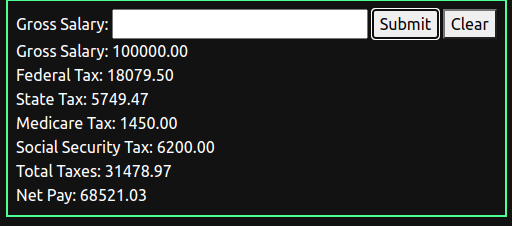

Hey there! I wanted to talk about a piece of code I wrote for a school project! It’s a program that calculates the amount of tax owed based on a given income and a set of tax brackets. It’s a relatively simple implementation that should be easy to follow, even if you’re new to programming.

Here’s an overview of how the Javascript code works, with some code snippets and explanations to make things clearer:

Step 1: Initialize Event Listeners

The first step is to initialize event listeners for the two buttons on the page: one for processing the salary input and one for clearing the results. Here’s the code for that:

const init = () => {

let salaryButton = document.querySelector("#salary-button");

salaryButton.addEventListener("click", processSalary);

let clearButton = document.querySelector("#clear-button");

clearButton.addEventListener("click", clearResults);

};

The init function sets up event listeners for the #salary-button and #clear-button elements. When the #salary-button is clicked, it calls the processSalary function, which we’ll look at next. When the #clear-button is clicked, it calls the clearResults function, which clears the results box on the page.

Step 2: Process Salary Input

The processSalary function is called when the #salary-button is clicked. It retrieves the gross salary input from the page and calculates the federal, state, medicare, and social security taxes owed based on the gross salary and a set of tax brackets.

1. Retrieve Gross Salary Input

const processSalary = (event) => {

event.preventDefault();

let grossSalaryInput = document.querySelector("#gross-salary");

let grossSalary = grossSalaryInput.value;

// Print gross salary

printResults(grossSalary, "Gross Salary");

// ...

};

The processSalary function first retrieves the gross salary input from the page using the document.querySelector method, and stores it in the grossSalaryInput variable. It then retrieves the value of the input using the .value property, and stores it in the grossSalary variable. Finally, it prints the gross salary to the results box using the printResults function.

2. Calculate Federal Taxes

const processSalary = (event) => {

event.preventDefault();

// ...

// Federal tax brackets

let fedBrackets = [

{ limit: 9875, rate: 10 },

{ limit: 40125, rate: 12 },

{ limit: 85525, rate: 22 },

{ limit: 163300, rate: 24 },

{ limit: 207350, rate: 32 },

{ limit: 518400, rate: 35 },

{ limit: Infinity, rate: 37 }

];

// Calculate federal tax

let fedTaxResults = calcTax(grossSalary, fedBrackets);

// Print federal tax

printResults(fedTaxResults, "Federal Tax");

// ...

};

The processSalary function initializes the fedBrackets array with the federal tax brackets, and calculates the federal tax owed using the calcTax function. It then prints the federal tax results to the results box using the printResults function.

3. Calculate Other Taxes

const processSalary = (event) => {

event.preventDefault();

// ...

// State tax brackets

let stateBrackets = [

{ limit: 11970, rate: 3.54 },

{ limit: 23930, rate: 4.65 },

{ limit: 263480, rate: 6.27 },

{ limit: Infinity, rate: 7.65 }

];

// Calculate state tax

let stateTaxResults = calcTax(grossSalary, stateBrackets);

// Medicare tax brackets

let medicareBrackets = [

{ limit: 200000, rate: 1.45 },

{ limit: Infinity, rate: 2.35 },

];

// Calculate medicare tax

let medicareTaxResults = calcTax(grossSalary, medicareBrackets);

// Social security tax brackets

let socialBrackets = [

{ limit: 137700, rate: 6.2 },

{ limit: Infinity, rate: 0 },

];

// Calculate social security tax

let socialTaxResults = calcTax(grossSalary, socialBrackets);

// ...

};

The processSalary function initializes the stateBrackets, medicareBrackets, and socialBrackets arrays with the state, medicare, and social security.

4. Calculate Total Tax and Net Pay

const processSalary = (event) => {

event.preventDefault();

// ...

// Calculate total tax and net pay

let totalTaxes = fedTaxResults + stateTaxResults + medicareTaxResults + socialTaxResults;

let income = grossSalary - totalTaxes;

// Print tax and income results

printResults(fedTaxResults, "Federal Tax");

printResults(stateTaxResults, "State Tax");

printResults(medicareTaxResults, "Medicare Tax");

printResults(socialTaxResults, "Social Security Tax");

printResults(totalTaxes, "Total Taxes");

printResults(income, "Net Pay");

// Clear input field

grossSalaryInput.value = "";

};

The processSalary function calculates the total taxes owed by adding up the federal, state, medicare, and social security taxes. It then calculates the net pay by subtracting the total taxes from the gross salary. Finally, it prints the tax and income results to the results box using the printResults function.

Step 3: Calculate Tax Owed

The calcTax function is the heart of the tax calculator. It takes in an income and a set of tax brackets, and calculates the total amount of tax owed. Here’s the code for that:

const calcTax = (income, brackets) => {

let tax = 0;

let previousLimit = 0;

for (let i = 0; i < brackets.length; i++) {

let bracket = brackets[i];

if (income >= bracket.limit) {

let taxableIncome = bracket.limit - previousLimit;

let taxForBracket = (bracket.rate / 100) * taxableIncome;

tax += taxForBracket;

previousLimit = bracket.limit;

} else {

let remainingIncome = income - previousLimit;

let taxForBracket = (bracket.rate / 100) * remainingIncome;

tax += taxForBracket;

break;

}

}

return tax;

};

The calcTax function initializes the tax variable to 0 and sets the previousLimit variable to 0. It then loops through each bracket in the brackets array and checks if the income is greater than or equal to the bracket’s limit. If the income is greater than or equal to the bracket’s limit, the function calculates the taxable income for that bracket by subtracting the previous limit from the current limit. It then calculates the tax owed for that bracket by multiplying the taxable income by the bracket’s tax rate (expressed as a decimal). If the income is less than the bracket’s limit, the function calculates the tax owed for the remaining income by subtracting the previous limit from the income and multiplying it by the bracket’s tax rate. The function adds the tax owed for each bracket to the tax variable and returns the total tax owed.

Step 4: Print Results

const printResults = (result, label) => {

let taxResultsDiv = document.createElement("div");

taxResultsDiv.setAttribute("class", "tax-results-div");

taxResultsDiv.setAttribute("id", label);

taxResultsDiv.innerText = label + ": " + Number(result).toFixed(2);

theResultsBox.appendChild(taxResultsDiv);

};

The printResults function takes in a result and a label, and prints them to the results box. It first creates a new div element using the document.createElement method, and sets the class and ID attributes using the setAttribute method. It then sets the inner text of the div element using the innerText property, and appends the div element to the results box using the appendChild method.

Here is the entire javascript code altogether with minor differences –

let theResultsBox;

const init = () => {

let salaryButton = document.querySelector("#salary-button");

salaryButton.addEventListener("click", processSalary);

let clearButton = document.querySelector("#clear-button");

clearButton.addEventListener("click", clearResults);

theResultsBox = document.querySelector("#results-box");

};

const processSalary = (event) => {

event.preventDefault();

let grossSalaryInput = document.querySelector("#gross-salary");

let grossSalary = grossSalaryInput.value;

printResults(grossSalary, "Gross Salary");

let fedBrackets = [

{ limit: 9875, rate: 10 },

{ limit: 40125, rate: 12 },

{ limit: 85525, rate: 22 },

{ limit: 163300, rate: 24 },

{ limit: 207350, rate: 32 },

{ limit: 518400, rate: 35 },

{ limit: Infinity, rate: 37 }

];

let fedTaxResults = calcTax(grossSalary, fedBrackets);

let stateBrackets = [

{ limit: 11970, rate: 3.54 },

{ limit: 23930, rate: 4.65 },

{ limit: 263480, rate: 6.27 },

{ limit: Infinity, rate: 7.65 }

];

let stateTaxResults = calcTax(grossSalary, stateBrackets);

let medicareBrackets = [

{ limit: 200000, rate: 1.45 },

{ limit: Infinity, rate: 2.35 },

];

let medicareTaxResults = calcTax(grossSalary, medicareBrackets);

let socialBrackets = [

{ limit: 137700, rate: 6.2 },

{ limit: Infinity, rate: 0 },

];

let socialTaxResults = calcTax(grossSalary, socialBrackets);

let totalTaxes = fedTaxResults + stateTaxResults + medicareTaxResults + socialTaxResults;

let income = grossSalary - totalTaxes;

printResults(fedTaxResults, "Federal Tax");

printResults(stateTaxResults, "State Tax");

printResults(medicareTaxResults, "Medicare Tax");

printResults(socialTaxResults, "Social Security Tax");

printResults(totalTaxes, "Total Taxes");

printResults(income, "Net Pay");

grossSalaryInput.value = "";

};

const printResults = (result, label) => {

let taxResultsDiv = document.createElement("div");

taxResultsDiv.setAttribute("class", "tax-results-div");

taxResultsDiv.setAttribute("id", label);

taxResultsDiv.innerText = label + ": " + Number(result).toFixed(2);

theResultsBox.appendChild(taxResultsDiv);

};

const clearResults = (event) => {

event.preventDefault();

theResultsBox.innerHTML = "";

};

const calcTax = (income, brackets) => {

let tax = 0;

let previousLimit = 0;

for (let i = 0; i < brackets.length; i++) {

let bracket = brackets[i];

if (income >= bracket.limit) {

taxableIncome = bracket.limit - previousLimit;

let taxForBracket = (bracket.rate / 100) * taxableIncome;

tax += taxForBracket;

previousLimit = bracket.limit;

} else {

let remainingIncome = income - previousLimit;

let taxForBracket = (bracket.rate / 100) * remainingIncome;

tax += taxForBracket;

console.log(bracket.limit + " = limit " + bracket.rate + " = rate " + income + " = income " + tax + " = tax");

break;

}

}

return tax;

};And that’s it! I hope this post helped you understand how the tax calculator works. If you have any questions or feedback, feel free to leave a comment below.